Robinhood is rapidly expanding its crypto and blockchain offerings, signaling a shift toward integrated digital finance.

By

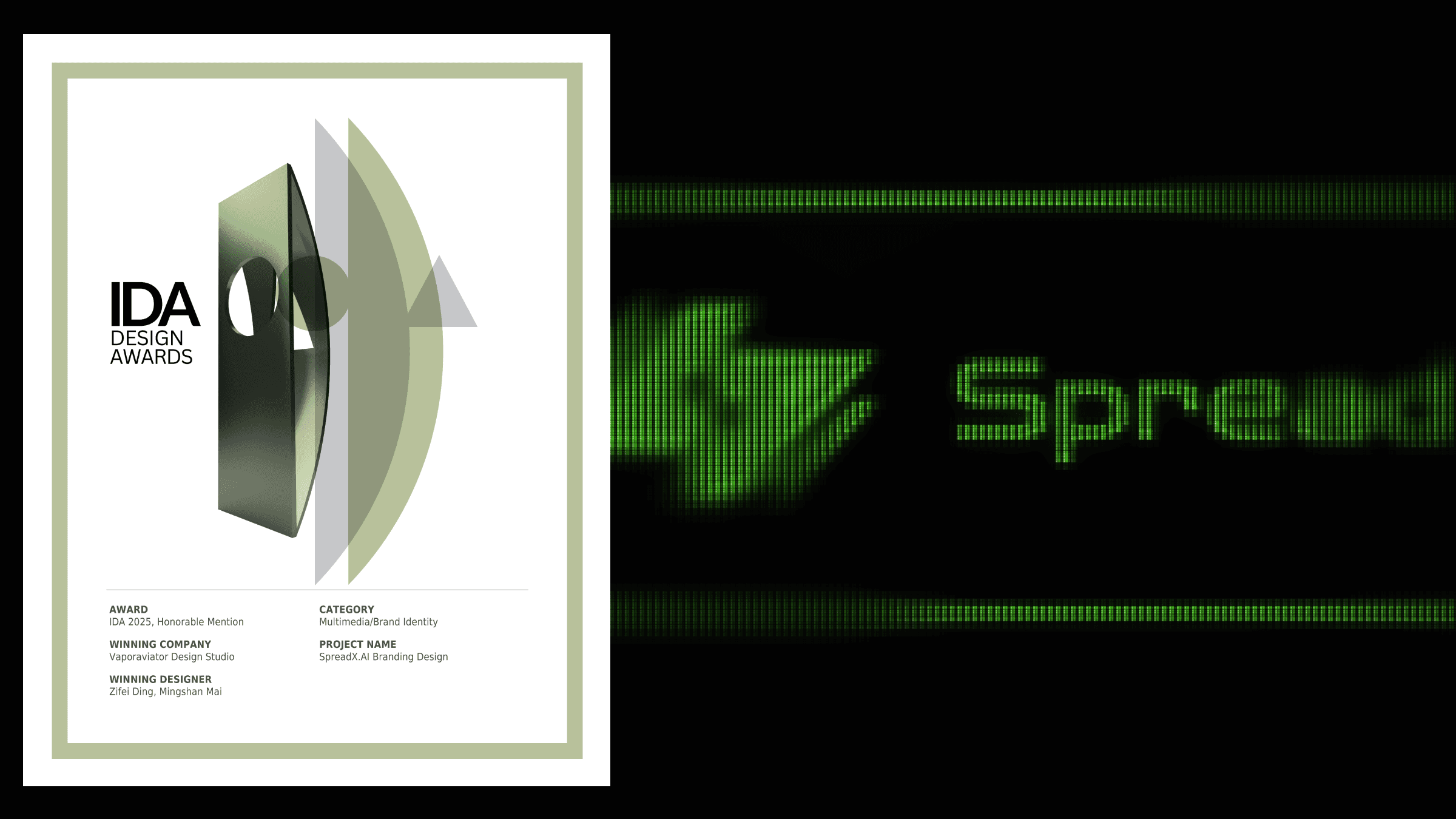

VaporAviator Lab

Jul 2, 2025

Quick Insights: Robinhood & Crypto Trends

Stock tokens for private companies like OpenAI and SpaceX are a breakthrough, opening new access and liquidity in private markets.

Impact of Private Company Stock Tokens

1. Democratizing Access to Private Markets

Traditionally, investing in private companies like OpenAI and SpaceX was reserved for venture capitalists, institutional investors, or insiders. By issuing stock tokens, Robinhood EU is making it possible for everyday investors to gain exposure to these high-profile, pre-IPO companies—something that was nearly impossible before.

2. Liquidity and Tradability

Private equity is notoriously illiquid. Tokenization allows fractional ownership and the potential for 24/7 trading, which could transform how value is exchanged in private markets. This could also set a precedent for other platforms and companies to follow, leading to a more dynamic, accessible secondary market for private shares.

3. Regulatory and Structural Shifts

This move will likely accelerate regulatory conversations around tokenized securities, investor protections, and cross-border trading. It also challenges traditional notions of share ownership, custody, and settlement, pushing the industry toward more transparent, blockchain-based systems.

+ Potential Future

Expansion to More Companies: If successful, expect a wave of other private tech giants and unicorns to be tokenized, further blurring the line between public and private markets.

New Investment Products: We could see the rise of index tokens, baskets of private company tokens, or even derivatives based on these assets.

Global Participation: Tokenization enables global access, so investors from regions previously excluded from US-centric private deals can now participate, as seen with Robinhood EU’s rollout.

Increased Pressure on Traditional IPOs: As liquidity and price discovery improve in tokenized private markets, companies may delay or rethink the need for traditional IPOs.

3 Emerging Patterns or Shifts

Mainstreaming of Crypto Rewards and Staking

Robinhood is launching staking for SOL and ETH, and introducing “Crypto Back” to convert rewards into crypto automatically.

This signals a move to make crypto earning and participation accessible to everyday users.

Mobile-First, Data-Rich User Experience

Advanced trading charts, previously for power users, are coming to mobile.

There’s a clear push to democratize sophisticated financial tools for a broader, mobile-centric audience.

Platformization via Blockchain Infrastructure

Robinhood is developing its own permissionless Layer 2 blockchain (“Robinhood Chain”) focused on real-world assets.

This marks a shift from being just a trading platform to becoming a foundational player in digital asset infrastructure.

What’s Driving These Changes

User Demand for Simplicity & Rewards: Consumers want seamless ways to earn, use, and interact with crypto—without technical barriers.

Competitive Pressure: Fintechs and exchanges are racing to offer more integrated, rewarding, and mobile-first experiences.

Regulatory Evolution: As regulations clarify, platforms are preparing to offer more advanced products (staking, perpetuals, tokenized assets) in compliant ways.

Implications for Professionals

Strategic Designers & Product Leaders: Need to anticipate user expectations for integrated, mobile, and reward-driven experiences.

Developers & Blockchain Specialists: Opportunities are growing in Layer 2 solutions, staking mechanisms, and real-world asset tokenization.

Compliance & Risk Experts: Must stay ahead of evolving regulations as platforms push into new crypto products and jurisdictions.

One Prediction for the Next 6 Months

Robinhood will launch its Layer 2 blockchain in beta, catalyzing a wave of fintechs exploring real-world asset tokenization and further blurring the lines between traditional finance and crypto. Within the next year, at least one major private company is expected to launch a tokenized equity offering directly to retail investors, prompting regulatory frameworks in the EU and beyond to rapidly evolve in response to this emerging asset class.

This is a tectonic shift—imagine a world where the boundaries between public and private, local and global, are as fluid and intricate as a living, breathing digital tapestry. The creative and strategic possibilities for founders, builders, and investors are immense.

Related Post

View more

View more